Your Transaction Disclosures

For most people, buying a home means securing a mortgage. During the mortgage application and closing process, you’ll receive a few different forms, intended to facilitate a more transparent transaction.

These forms include the Loan Estimate, Closing Disclosure and Settlement Statement. Generally, you’ll receive your Loan Estimate and Closing Disclosure from your lender, while your Settlement Statement will be provided by your title company, escrow officer or settlement agent.

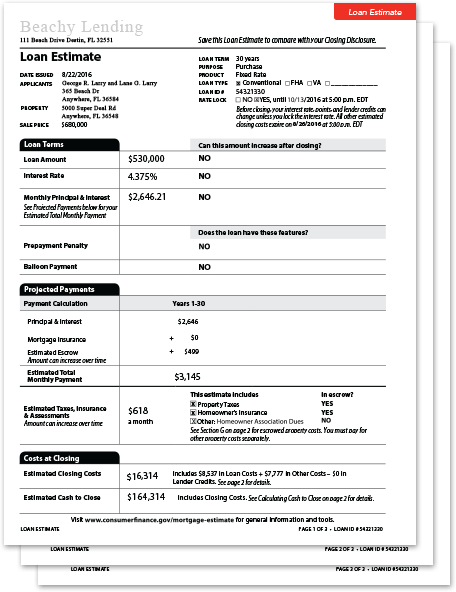

Loan Estimate

The Consumer Financial Protection Bureau, or CFPB, requires your lender to issue a Loan Estimate within three business days of receiving your mortgage application. The Loan Estimate details the terms of your loans along with estimated closing costs.

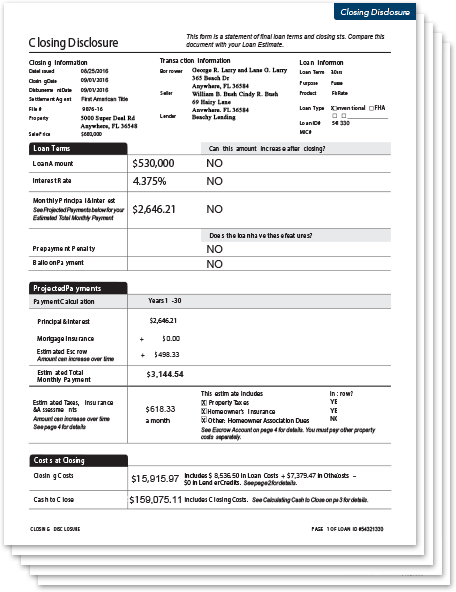

Closing Disclosure

The Closing Disclosure is also required by the CFPB. While your lender is charged with providing this document, it may assign that responsibility to your settlement or title company. You’ll receive your Closing Disclosure at least three business days prior to your transaction closing.

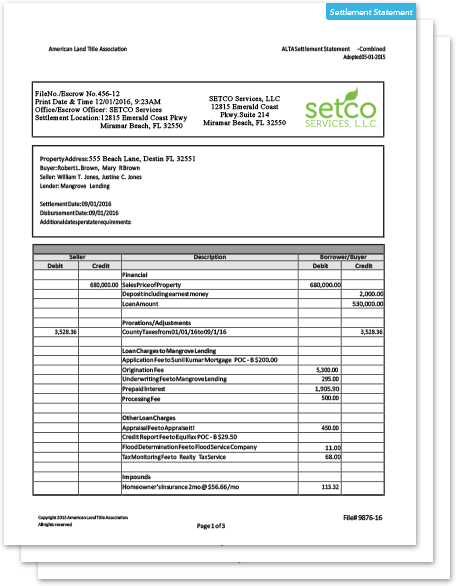

Settlement Statement

You’ll receive a Settlement Statement from your title company or other settlement agent at the close of your transaction. This document details the final costs and fees paid or funds received through your transaction, and may be helpful for your records and for tax purposes.